How to Get Digitized TIN & Digital TIN IDs

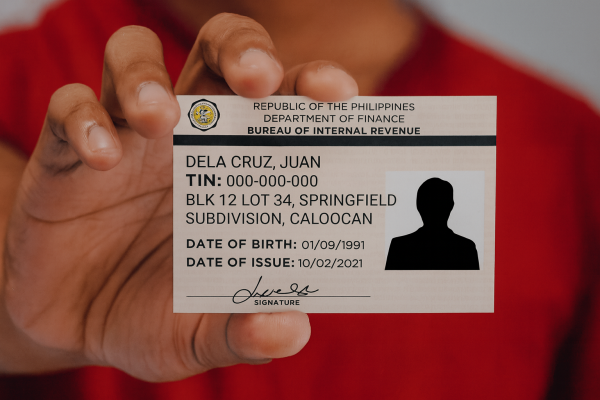

If you want to transact with government offices or banks in the Philippines, you’ll need a TIN. The good news is that securing a TIN ID is one of the easiest processes compared to other government IDs. Today, there are two versions: the Digitized TIN ID (physical plastic card) and the Digital TIN ID (downloadable card via ORUS). Both are valid and recognized.

Digitized TIN ID vs Digital TIN ID

- Digitized TIN ID: A physical plastic card issued by the Bureau of Internal Revenue (BIR) at your Revenue District Office (RDO). It replaced the old yellow cardboard TIN card, does not expire, and is still widely accepted.

- Digital TIN ID: An electronic version generated through the BIR’s Online Registration and Update System (ORUS). You log in, upload a compliant photo, and generate your card in minutes. It is valid under Revenue Memorandum Circular 120-2023 and can be regenerated every 30 days if details need updating.

Both are legit. The digitized card is useful if you prefer a physical ID, while the digital version is faster and convenient for online and offline transactions.

TIN ID vs UMID

It’s common to confuse the TIN ID with the UMID. Here’s the difference:

- TIN ID: Issued by the BIR, it proves you have a Taxpayer Identification Number. It is used mainly for tax-related purposes and government or financial transactions that require proof of tax registration.

- UMID (Unified Multi-Purpose ID): Issued by SSS, GSIS, Pag-IBIG, and PhilHealth, it consolidates social security and benefit information. It is a multi-agency ID but does not replace your TIN ID.

In short, the UMID is for benefits and contributions, while the TIN ID is for taxes. Both serve different purposes, and having both can make your life easier.

Who Needs a TIN?

A TIN is required for almost all adult Filipinos who need to transact with the government or formal financial institutions. You will need a TIN if you fall under any of these categories:

- First-time job seekers and employees

- Self-employed individuals, freelancers, and professionals

- Mixed income earners

- Non-taxpayers applying under Executive Order 98 (to transact with government agencies like LTO, DFA, or for banking requirements)

Where Are TIN IDs Usually Required?

Your TIN ID, whether digitized or digital, is often needed in the following scenarios:

- Opening a bank account (most banks require a TIN ID or proof of TIN)

- Applying for loans or credit cards

- Registering a business with DTI or SEC

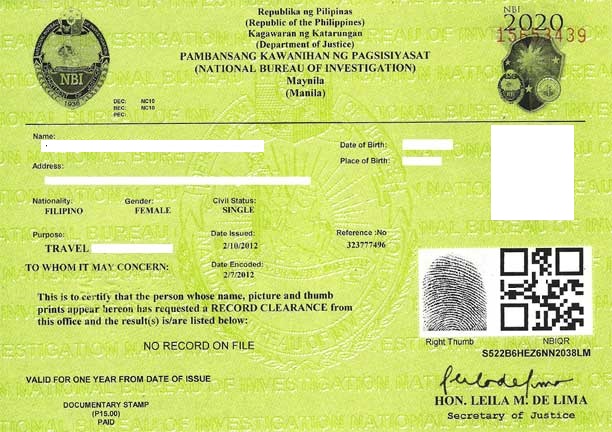

- Transacting with government offices such as LTO, NBI, DFA, and Pag-IBIG

- Employment requirements when being hired by a new company

- Filing taxes or dealing with the BIR

Requirements Before Applying

Before you apply for either a digitized or digital TIN ID, make sure you have the following:

- A valid email address (for online application)

- A valid government-issued ID (Passport, Driver’s License, SSS ID, Comelec Voter’s ID, etc.)

- A copy of your Philippine Statistics Authority (PSA/NSO) Birth Certificate (especially for first-time applicants)

- A 1×1 ID photo with white background for the Digital TIN ID

- For self-employed individuals and single proprietors, payment of the ₱500 registration fee at an Authorized Agent Bank (for business registration)

How to Apply for a Digitized TIN ID (In-Person)

If you prefer to go directly to a BIR office, here are the steps:

- Visit your assigned BIR RDO – This should be the RDO with jurisdiction over your residence or workplace.

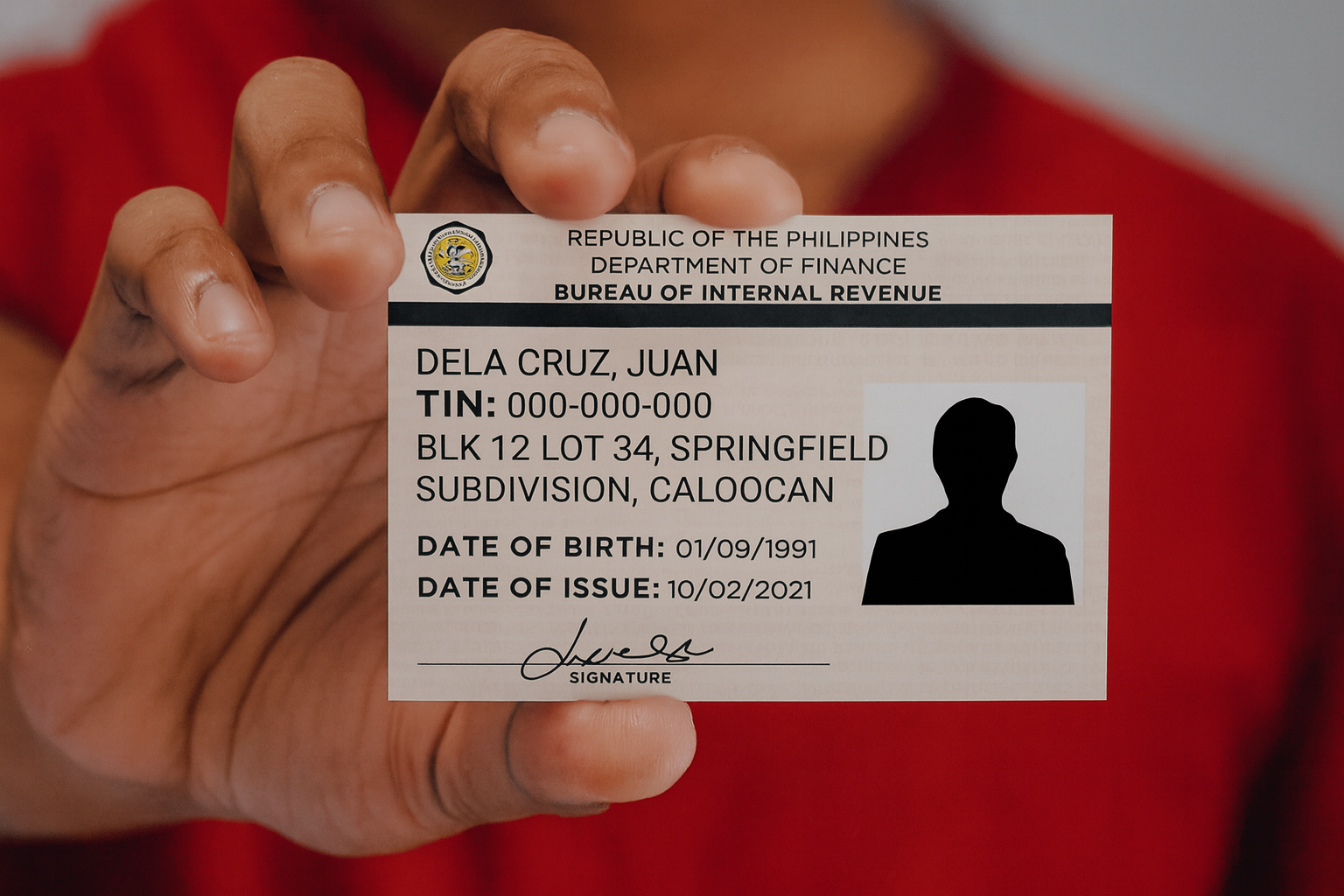

- Request the correct TIN application form:

- BIR Form 1902: For employed individuals

- BIR Form 1901: For self-employed individuals or professionals

- BIR Form 1904: For those applying under Executive Order 98 (non-taxpayers)

- Fill out the form completely and accurately – Double-check all details to avoid delays.

- Submit the form along with your valid ID and supporting documents – The officer will check everything.

- Receive your TIN number – This is typically processed on the same day.

- Request for your Digitized TIN ID – If printing services are available, you can claim it the same day. Otherwise, you may need to return after a few days.

The digitized TIN ID is a valid, government-issued ID that does not expire.

How to Apply for a Digital TIN ID (Online via ORUS)

For convenience, the BIR now allows taxpayers to apply online and generate a Digital TIN ID. This method is particularly useful for first-time applicants and those who want a digital copy quickly.

Step 1: Register at ORUS

- Go to the BIR ORUS portal.

- Create an account using your valid email address.

- If you already have a TIN, select With Existing TIN. If you are applying for the first time, select Without Existing TIN and choose “Get TIN for Filipino Citizen – E.O. 98 / One-Time Taxpayer”.

- Verify your email immediately since the verification link expires within 24 hours.

Step 2: Fill Out the Registration Form

- Complete the online form with your personal information, address, and purpose of application.

- For first-time applicants, this replaces the old manual process of filling out Form 1904 in person.

- Upload any required attachments in the allowed formats and file sizes.

Step 3: Submit and Wait for Approval

- After submission, you will receive an Application Reference Number (ARN) and be assigned to a specific RDO.

- Wait for an approval email from the BIR. Processing times may vary depending on your assigned RDO.

Step 4: Generate Your Digital TIN ID

- Once approved, log in to ORUS.

- Click on Get Your Digital TIN ID in the left-hand menu.

- Click View Your Digital TIN ID.

- Upload your 1×1 photo with white background.

- Generate and download your Digital TIN ID.

- Note: You can only regenerate your digital ID once every 30 days.

Fees and Reminders

- TIN issuance is free of charge.

- Single proprietors and professionals must pay a ₱500 registration fee for business registration.

- Only one TIN per person is allowed. Applying for more than one TIN is a criminal offense punishable under the National Internal Revenue Code of 1997.

- Acceptance of the Digital TIN ID may vary depending on the institution. Some banks and agencies may require the physical digitized card, so having both can be practical.

FAQs

Is the Digital TIN ID a valid government ID?

Yes. It is officially recognized under BIR guidelines. However, some private institutions may still prefer the physical card.

Does the UMID replace the TIN ID?

No. The UMID is a multi-purpose ID used for SSS, GSIS, Pag-IBIG, and PhilHealth transactions. The TIN ID, whether digitized or digital, is specifically for tax and BIR-related matters.

Can I apply for both digitized and digital TIN IDs?

Yes. You can request the physical card at your RDO and also generate the digital version via ORUS. Both remain valid.

How long does online approval take for first-time applicants?

Approval times vary per RDO. Some applicants get approval within a day, while others may wait several days depending on workload.

Is the old cardboard TIN ID still valid?

Yes. The old yellow cardboard TIN ID is still considered valid, but it is being phased out in favor of the digitized plastic and digital versions. If you still have the cardboard ID, you may continue using it, though some institutions may prefer the updated versions.

Are barangay clearance, police clearance, and mayor’s permit valid IDs?

Barangay clearance and police clearance are accepted as valid secondary IDs, useful especially for proving identity or residence. The mayor’s permit is not an ID. It’s commonly used as a business registration document, for example when opening a corporate bank account, but not suitable for personal identity verification.

Final Thoughts

Both the Digitized TIN ID and the Digital TIN ID are valid and useful. The digitized card gives you a physical ID, while the digital version provides convenience and accessibility. If you need a quick, reliable government ID for official or financial transactions, securing either form of TIN ID is one of the most practical steps you can take.

Gud am po b ko makakuha ng tin no. Then tin id,kc ggmitin kk sa pgkuha ng passport…

Hi I emailed them BIR about the Digitized Tin ID

“RN 2017-034362

Dear Sir/Madam:

Greetings! Thank you for communicating with the BIR Customer Assistance Division.

In reply, if you have been issued a TIN but have not been issued a TIN Card yet, you need to coordinate with the BIR – Revenue District Office (RDO) where your TIN is registered to find out whether a TIN Card has already been printed under your name or one has to be printed still upon request. Regarding how long will it take for your TIN Card to be printed, depends on the workload of the RDO where you are currently registered.

Further, please be informed that effective May 2002, plastic TIN cards (just like in SSS / GSIS) shall no longer be issued by the BIR – RDO. Instead, TIN cards for new applicants and/or reprints shall be issued in cardboard form / type pursuant to Revenue Memorandum Order (RMO) 10-2002. You may inquire from said office how soon your TIN card can be released. You are also informed to present valid identification card/s upon claiming of the same. You can avail of the same for free.

For other inquiries, you may visit http://www.bir.gov.ph. We appreciate your continued support.

Sincerely,

The BIR Customer Assistance Division

E-mail: •••••••••••••••••••••“

i hve already a tin id card .but it is not accepted in dfa for passport application how,can i get a digitize tin card

kailangan pa ba mag antay ng email for the tin numnber or pumunta na sa bir.

Punta na lang po sa BIR. para po sure

Gud pm, panu po mkakaiha ng digitized bir id..d po kc tinatanggap ung yellow id ng bir..neee k po pra mkakuha ng passport tnx

Paano po kong hindi ko nkuha yung tin id pero my tin no. Nmn pwde pa po ba ako mkakuha nang digitize id?

Pwede po b kumuha ng TIN ID khit wla n kong employer? Pero meron po akong TIN #?

Magandandang arae po sir / mam, may tin number na po ako at need konpo yung tin id.pwd ba ako magpapautos sa kamag anak ko dahil wala ako sa pinas.salamat po.

Magandandang arae po sir / mam, may tin number na po ako at need konpo yung tin id.pwd ba ako magpapautos sa kamag anak ko dahil wala ako sa pinas.salamat po.

San po pwde kumuha ng ID mlpit dto sta.rosa

PWEDE PO BA ULIT KUMUHA NG ID CARD,NANAKAW PO KASE UNG WALLET Q, ANDUN LAHAT ID’S Q,KASAMA ANG TIN CARD Q,PWEDE PO BA ULIT KUMUHA?AND ANU PO REQUIREMENTS?

Im also na lost TIN ID ko ,pwede po ako uli kumuha ?Aano need requirements?

Secure first Affidavit of Loss in the nearest Notary Public in your area. Then submit the AoL in the RDO where your TIN is registered. Bring a valid for verification purposes.You may coordinate in the personnel there how long will you getting the replacement. But it depends on the workload of your RDO

Paano po kung wala akong id na nandun sa lis ano pa po b yung pwedi gmitin?

gud am may TIN na po ako dati mga 20+ years ago na, pwede pa ba ito gamitin kahit di ako nag file ng ITR..pwede ko pa ba ito ipa digitized id.

Yes po pwedi po .

Hello ask kolang po…pwede po bang kumuha ng digitized id…pero meron ako ng card id…ung dilaw…..kasi need ko sa passport d man pwdede ung yellow card…reply po..

Gud pm ask ko lang po kung pwede po philhealth id at NBI Clearance para makakuha ng TIN ID? Salamat sa magrespond. 🙂

Gud pm ask ko lang po kung pwede po philhealth id at NBI Clearance para makakuha ng TIN ID? Salamat sa magrespond. 🙂

Can i use the old birth certificate when applying a Tin Number?

Can i use the old birth certificate when applying a Tin Number?

may bayad po ba pagkuha ng tin i.d? thanks,

may bayad po ba pagkuha ng tin i.d? thanks,

i would like to ask why is it walang available Tin card sa BIR BGC ?

How many days process for the id? Thanks.

good day po,iba p po b ung tin id s digitized bir id?tnx po s magrereply

any valid ID po na pede sa requirements bukod sa given sa taas… i have SSS po pero E1 lang

saan malapit n sattelite office dto s molino 3 bacoor cavite??? pls reply asap or call 09277983124

Panu po mag apply ng tin number while abroad any online site.salamat po sa help..

Panu po mag apply ng tin number while abroad any online site.salamat po sa help..

mga serbisyong bulok.. magagaling lang maningil

Gud pm.. i have my old tin id.. gusto ko po sana ipa digitalized meron po ba online registration.?

Pano po kaya yun? I dont have an sss nor a voters id. Company if lang po ang meron ako dahil nawala yung mga ids ko. Pwede po ba kayang philhealth id ang ipresent saka company id? May mga copy po ako nung mga ids ko nawala sa phone ko pero wala na nga po yung physical card dahil nawala. Please help me. Thanks!

Pano ba ko makakakuha ng Tin i.d? Thanks.

may bago ako work…pero need nila nang Government ID para sa payroll ko. ayaw nila ng Barangay ID e. so TIN nlang. kaso nawala po yung TIN ID ko, how can i apply for replacement ID na digitized na po? thanks!

good day bukod s req. above n vlid id my iba p po b?? na pwd

esue n po b nw `ang digitize tin id pnu po kng mrun n tin id n loma`same lng po ung number ng bgong id n kukunin ku.txtbk plz

Confirm ko lang po, existing pa rin ba Digitized Tin ID or yun n lang yellow ID meron ang BIR? kelangan k kasi ng digitized ID para sa pagkuha ng passport.

Panu poh ba kukuha ng digitalized tin id???? Thnx poh

Pumunta ako ng BIR tinanong ko kung degitized na ba ung id na makukuha ko kung sakali..hindi raw..kailangan kpa sana sa passport

Paano po ako makakapagchange status kung nasa labas po ako ng ibang bansa need ko po sa nabili kong lupa , yung asawa ko na invalid person ho siya pareho ho kaming nasa ibang bansa pwede ho Dn siya ng kumuha ng tin kahoy ala sya trabaho

Available na ba yung digitalized?? And mabilis lang ba to makuha?

I aleady have a tin i just need the TIN card

good pm po, pwede po ba akong kumuha ng tin no. & tin id kahit wala pong work?

Makakakuha bah Aquh ng tin id in just one day

yes you can maam

hi paano po kaya yun yung record ko po at sa tin id ko mali po yung nakalagay na birthday

gud pm pnu b kumuha ng tin i.d

Maam’sir’kaya po kmi kumukuha ng Digitized BIR ID kc po wla po kming valid id.postal digitized lng meron. Pra po sa passport kya kmi kumukuha ng Digitized BIR ID po. Ung voters id nman moh certificate lng meron tsaka po ung mg old id nmin nawala po at ung sss id nman po hindi pa makuha kc 3 to 5 month pa daw makuha kya po kmi kukuha kc sabi nla mas madali po kumuha dyan nid po kc nmin for abroad.sna po kht postal digitized nman po yan tsaka kya kmi ngpagawa ng gnun kc sbi valid na po un pero bkt di tinatanggap dfa.grabe nman po cla pinapahirapan nla ang mga taong nangangailangan para mgtrabaho abroad samantalng un lng gawain nla.

Panu po makakuha ng tin..gagamitin q sana makakuha ng drivers lisenced

Gud am po san po pwede mag bayad ng panibagong TIN ID? Kasi po nag pabago po kasi aq ng apelido.

Sa AABs mo.

Gud pm po, pwede po b Ang voters certificate para mkakuha ng tin id, ksi Mali po Ang nilagay na name ko sa id. Please reply po para malaman ko kung pwede Ang voters certificate.. Tnx

meron na akong tin number pero wala pa akong tin card, paano po ba maka kuha ng tin card? please help po…

Pwede po ba kumuha ng tin id card sa bir manila kung nka register ung tin number ko sa bulacan.. nung binigay ksi ng employer tin number ko pag check ko sa bir manila sa bulacan daw sya nka record eh dto ako sa mnila nag wwork

Yes by due process. Kuha ka ng Form 1905 and put x dun sa change of registered address. Then fax mo yon sa office kung san ka nag apply ng tin. Ipatransfer mo kung saang RDO mo balak ilipat at kung san ka kukuha ng card. After noon a maximum of 1 week balikan mo ung new RDO mo to verify kung nasa RDO na ba nila ang tin mo. Saka ka kukuha ng Form 0605 to pay the card replacement fee.

If working online, is it punishable by law if you are not going to pay taxes?

Yes it is.

my tin number na ako,paano ako makakakuha ng tin id?punta b ako bir

Yes. Pupunta talaga kayo.

kailan magiging pvc – id yung id ng TIN?

I got married na po gusto ko po sna papalitan apilyedo ko sa bir id ko. Pano po ba? Thanks for your response in advance.

Panu po ba kimuha nang digitized tin id kailangan ko po kase sa passport at ilang araw po ito marirelease

Hello po.. bakit TIN number lang po binigay ng BIR .wala po ung ID card . Kamahal pa ng singil nila. Ilang days po ba bago makuha yung TIN ID card?- thanks.

San po ba pwede mgrequest ng digitized tin id.ang hirao kumuha dito sa cabanatuan ordinary na tin id na nga lang hirap p kumuha pblik blik ako.ggmitin ko po sana sa pgkuha ng passport..

MYRON NPO BA TALAGANG DIGITIZED TIN ID? PARANG WLA PA NAMAN PONG YATANG INI-ISSUE SI BIR NA GANUNG ID PURO LUMA PARIN KARTON

Is that possible if kumuha ako ng TIN ID dito sa Quezon, kahit nakaregister ako under employer e sa Calamba Laguna but hindi na ako employed dun ngayon dito na ako sa Quezon employed and nag sstay?

If not? how to change may employer from employed to self employed nalang?

Pwd po bang magpakuha ng id o hindi nd how to know it is true?

Pwde po ba yung Philhealth id

Good pm po Lang days po any process ng ID?

San po Aq pwedeng kumuha ng TIN digitized ID..? Pwede po ba sa BIR fisher mall..? Qc po ako nkatira Pero sa Las pinas po ang office q ? Bukas po b kayo sa Oct 31?

Ano pong itsura ng digitized na tin id

Meron na akong TIN card pero ung luma pa at iba na address ko. Saan ako pde mag papalit ng digitized TIN card?

Good day! ask ko lang po what if first timer ka pa lang po kukuha ng TIN and your not yet employed kasi need siya ng company na pinagaaplyan mo. What to do? I need someone to give me clarified and clear information about this matter thank you and god bless.

ano po ba ilalagay sa registered adrress sa form to get tin id? company adrress po ba or home adrress? thans po.

Good day..ask ko lang po if pwede kumuha foreigner ng TIN id dto .under e.o 98 po..student po.

And ano po requirements for foreigner who wants to get TIN under e.o 98 po?

Paanu po kung meron ng old tin id?kylangan pa po ba ng requirements or ids?

May update po ba sa digitized bir id

walang pong dumating sa email ko na TIN ID

pwede po bang magsign ulit pero ibang email naman na?

hello po, ask ko lang po sana. nag apply po ako ng TIN nung last october 10, form 1904 po. wala po binigay na id. bakit po? pero pwedi po ba ako mag request, gagamitin ko po sana sa passport ko. salamat po sa response

Hello, Gusto ko po sana magpaverify ng TIN number kung may TIN number na po ba ako kasi po nung unang work ko po pina fill out niya po kami ng form para sa application ng TIN number . Pero nag endo nalang po ako d parin po nila binibigay ang TIN I.d ko po. i am not sure lang po kasi naka registered na po ba ako sa TIN number. Ang saklap pa po yung HR po namin wala na din po dun sa dating pinagtatrabahuan ko po. Paano po kaya yun. kailangan ko na po sana makakuha ng TIN number or I.d for banking purposes lang po sana. Thank you po sa makakatulong saakin.Godbless

Hi,

I just want to ask I resigned from my previous employer yung first previous employer ko. When i went to bir cebu hindi po cla mag iisue ng ID e kasi nasa manila o sa quezon city ako naka online. Paano makakuha ng ID nasa cebu ako at tsaka yung employer ko before wala na?

Thanks!

Sa valenzuela po ako kumuha ng tin number,nung nagchange status po ako,sa bir quezon city na inupdate ng employer ko ung status ko.saan po ba ako kukuha ng tin id?thanks.

May bayad po ba pagkuha ng tin id.kasi my tin id assistance 300 byad

Pwede bang ideliver yung TIN ID sa location ko?

Meron na po akong TIN # before pero no digitized ID yun yellow pa din po. Paano po ako makakakuha ng digitized ID and meron po ba office dito sa sta rosa?

Ask ko lang po bakit 1 month ng walang id card sa 043 pasig bir sobrang need ko lang po yung valid id sana po maayos na salamat

Meron na po akong tin id. Gusto ko lang po siya palitan ng adress kasi ang nakalagay na address ay present address ko kung saan ngbbord lang ako. Paano po gagawin para palitan at permanent adress ang ilagay?? Slamt po sa sasagot

ask ko lng po,hanggang anong oras po realesing ng tin card dito sa iloilo?pag may 1902 na & nareceived ng ng employeer yung printed na inaaply ng employeer,ano po next step,un approachable po ksi nga staff ng BIR sa plazuela iloilo,incomplete po mga details@tinatanong namin kung pano,ang processing masungit pa sila,kaya pabalik balik kmi,nasasayang ang oras pabalik balik po.

meron na po kming tin # & 1902 from employeer,sabi ng guard needed pa daw ng coe?pati birth certificate?d po yung req.na mga yun for registration pa lng? kailangan pa ba nmin magdala ulit ng mga requirements?we’re applying for a tin card na po ksi meron na kming tin no.

May bayad po ba pag kumuha po NG tin number.. At anung form po ang kukunin ko..

gud evening po ma’am/ Sir. Please po baka pwedi po makahinge ng tulong para malaman ko po ang TIN number ko po TYPO.

Wla pa po akong tin # pano po kumuha??

Saan po sa Antipolo City makakakuha ng TIN ID na Digitized Id?

Good day!

Query ko po, what’s the difference between the TIN ID and the Digitized TIN ID?

May tin number na ako’ kukuha sana ako ng ID, dito sa cagayan de oro city ang sabi sa akin yung RDO 031,manila sta cruz..dapat doon daw ako kukuha’ eh dito ako sa cagayan de oro city nagtatrabaho..reply naman po’ salamat ng marami

Pwede ko po ba gamitin ung tin id ko sa business kong nagsara na for my work now?

Dear Sir/Madam,

I would like to know my TIN Number, I Lost it when I retired. If you can help me appreciated much.

Good day po! May tin number na po ako, nned ko po ng id kaso hindi po ako makapunta ng BIR pa. Nag try po ako mag gawa ng ORUS account for digital ID kaso ayaw po magenerate. ano po kayang problema sa ganong case and ano po kaya magandang gawin? Thanks po.