How to Apply for a Taxpayer’s Identification Number (TIN) at the BIR

The Taxpayer Identification Number (TIN) is a number that identifies a taxpayer. It is very important not only to the taxpayer but also to the government.

Procedures in securing a TIN differ on the basis of the classification of the taxpayer.

A. Individuals Earning Purely Compensation Income

Requirements:

- NSO Birth Certificate of the applicant; or

- Passport (in case of non-resident alien not engaged in trade or business);

- Waiver of husband on his right to claim additional exemptions, if wife will claim;

- Marriage Contract, if applicable.

- NSO Certified Birth Certificates of declared dependents, if any.

Procedure:

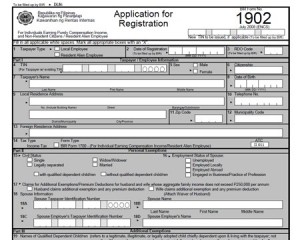

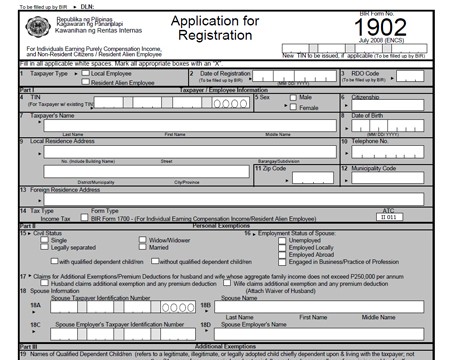

Step1: BIR Form 1902

Step1: BIR Form 1902

Accomplish BIR Form 1902 and submit along with the necessary documents to the employer.

Step 2: Employer

The employer then fills-out the applicable sections in the application form.

Step 3 : Submission

Submit BIR Form 1902 to the Revenue District Officer (RDO) who has jurisdiction over the place where the employee works.

Deadline:

The employer or the employee must file the application within 10 days from date of employment.

B. Self-Employed and Mixed-Income Individuals

Requirements:

For single proprietors, mixed income earners

- Photocopy of Mayor’s Business Permit

- NSO Birth Certificate of the applicant

- For Professionals

- Occupational Tax Receipt (OTR) or Professional tax Receipt (PTR)

- NSO Birth Certificate

- Marriage Contract (if married)

- Contract/Company Certification

For Non-Residents

Same as above plus Working Permit

For Franchise Holders/Franchisees

Same as above plus photocopy of Franchise Agreement

Step 1: BIR Form 1901

Fill out BIR Form 1901 and submit together with all the documentary requirements indicated above to the Revenue District Officer (RDO) who has jurisdiction over the place.

Step 2: Payment

Pay the Annual Registration Fee (PhP 500.00) at the Authorized Agent Banks (AAB) of the RDO. Pay Documentary Stamp Tax (DST). Present proofs of payments.

Step 3: Briefing

New registrants should attend the initial taxpayer’s briefing conducted by the RDO for the new applicants in order for them to understand their rights and responsibilities.

Step 4: Issuance of Certificate

The RDO will then issue the Certificate of Registration (Form 2303) together with the “Ask for Receipt” notice.

Deadline

All taxpayers should accomplish their application on or before the start of business operations. It shall be reckoned from the day when the first sale transaction occurred or within thirty (30) calendar days from the issuance of Mayor’s Permit/Professional Tax Receipt (PTR) by LGU, which ever comes earlier.

Corporations/Partnerships (Including Government-Owned and Controlled Corporations)

Requirements:

1. For Corporations/Partnerships

- Copy of SEC Registration and Articles of Incorporation/Articles of Partnerships

- Copy of Mayor’s Business Permit ( received Application for Mayor’s Business Permit if it is still being processed)

- Other documents may include:

- a) Contract of Lease;

- b) Certificate of Authority if Barangay Micro Business Enterprises (BMBE) registered entity;

- c) Franchise Agreement;

- d) License to Do Business in the Philippines, in case of resident foreign corporation;

- e) Proof of Registration/Permit to Operate with BOI, SBMA, BCDA, PEZA.

- For Cooperatives

- Copy of Cooperative Development Authority (CDA)

- Certificate of Registration and Articles of Cooperation

- For GAIs, GOCCs and LGUs

- Copy of the Unit or Agency’s Charter

- For Home Owner’s Association

- Copy of Certificate of Registration issued by Housing and Land Use Regulatory Board (HLURB)

- Articles of Association;

- For Branch/Facility type

- Copy of the COR of the Head office for facility type to be used by the Head office

- COR of the branch for facility types to be used by a particular branch

- Mayor’s Permit

- Contract of Lease, if applicable

- Application of Authority to Print

- BIR form 1906

- Job order

- Final & clear sample of Principal & Supplemenatary Receipts/Invoices

- Registration of Book of Accounts

- New set of books of accounts

Procedures:

Step 1: BIR Form 1903

Fill out BIR Form 1903 and submit along with the other documentary requirements to the RDO who has jurisdiction over the place where the head office is located.

Step 2: Payment

Pay the Annual Registration Fee (PhP500.00) and Documentary Stamp Tax (DST) at the AAB’s. Submit proofs of payment.

Step 3: Briefing

New registrants should attend the taxpayer’s initial briefing conducted by the RDO in order for them to understand their rights and responsibilities.

Step 4: Issuance of Certificate

The RDO will then issue the Certificate of Registration (Form 2303) together with the “Ask for Receipt” notice, Authority to Print and Books of Accounts.

Deadline:

Corporations and their branches should file their application on or before the start of business operations. It shall be reckoned from the day of the first business transaction or within 30 days from the issuance of Mayor’s Permit or the SEC Registration whichever comes earlier.

magandang hapon po.?itatanung ko lang po sana kung pwd po ba akung makakuha ng BIR ID..kasi po kukuha ako ng passport..isa lang po kc ID ko na hawak ngaun..Digitized postal ID lang po..pwd po ba.?

thanks po.

magandang hapon po.?itatanung ko lang po sana kung pwd po ba akung makakuha ng BIR ID..kasi po kukuha ako ng passport..isa lang po kc ID ko na hawak ngaun..Digitized postal ID lang po..pwd po ba.?

thanks po.

good morning po ask qlng po.if pde mkuha my tin id khit saang branch..meron n po aq id number ung idcard nlng po kailangan q

Good afternoon po bakit po dito sa Balibago saver Angeles city hindi daw po sila nagiissue ng digitized BIR ID…

hello po paano magpaverify ng TIN number kung meron na po ako? Thank you

Good afternoon po.. May i ask po kung anung form ang gagamitin kung sakaling mag online regester ako para makakuha ng BIR TIN?

i want to apply a new TIN coz i did not recognized my TIN number when i lost it since 1997. then i want to apply a new one via online but how?

gud am po anong form po ang ggamit s pag appky ng tin id number

Good day po sir/mam, patulong po sana ako kung anu step gagawin ko para ma recover ko Tin number ko because I forgot it a year ago. Salamat po

Meron napo akung tin id number id nlang po wala patulong nman po